When you are gambling in the casino, you might win a few dollars from time to time by departing with elevated dollars than you introduced with you. It might be under $20, or around $1,000. When cashing out you are never presented you through an application to declare your winnings for that IRS. If you feel you are home free, reconsider. As being a U.S. citizen, the debt The Us Government a few of the experience whatever the amount. Many players believe that ever since they were not given a tax form there’re home free. Not so.

So, how much does get reported for that IRS? Bigger amounts which are won at gambling houses for example casinos, lottery retailers, horse race tracks and off-track betting parlors. They’ll issue a charge card applicatoin W-2G, one copy to suit your needs the other for that IRS. Right here are a handful of details:

Machine Games

$1,200 or higher won in the video slot, electronic poker, video keno, video blackjack, etc. This only applies one jackpot payout amount. Accrued credits are credit meter wins and don’t count.

$1,200 or higher won in the live bingo game may also trigger a W-2G, and $1,500 or higher in the live keno game (minus your wager amounts).

The casino won’t withhold any gambling taxes from awards within the $1,200 to $1,500 range provided you present the very best photo ID and ssn. If you don’t provide this info, 28% will most likely be withheld.

Live Table Games

Winnings from live table games aren’t reportable round the W-2G, until there’s a very large prize amount offered for almost any small wager, as being a dollar bet for almost any shot in the progressive table jackpot, in which the winning chances are over 300/1 along with the win is much more than $600. For instance, Caribbean Stud offers a huge progressive-jackpot for wagering only $1, if you are fortunate enough to hit a Royal Flush.

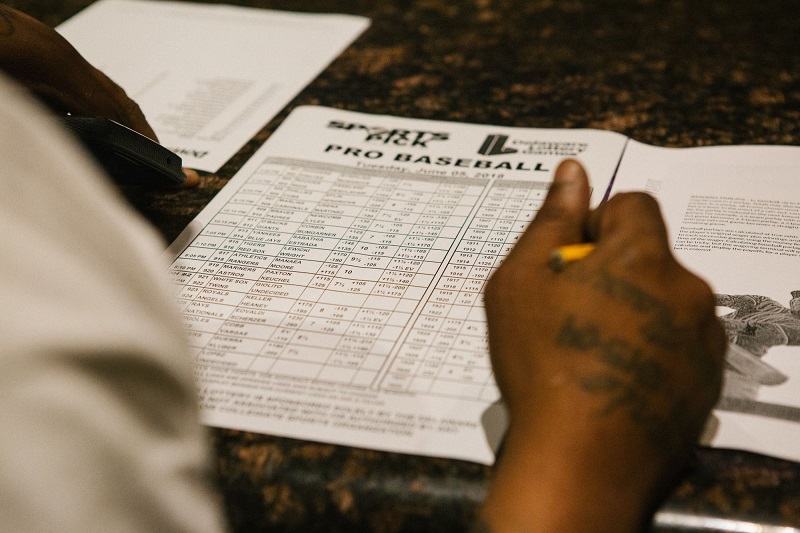

In case you win $600 or higher in almost any other wagering game, for example horse, dog racing or sports betting, along with the amount reaches least 300 occasions your bet minus your wager amount, the establishment will gift you obtaining a W-2G. In situation your winnings exceed $5,000 along with the amount is much more than 300 occasions your bet, 25% will most likely be withheld. Exactly the same withholding percentage will also apply for the cash prize of $5,000 or higher in poker or any other card tournaments without any buy-in amount.

Winnings on condition lottery games for example lotto, figures, scratch-offs, etc. may be collected from our store around $600. Any more and you will have to go to the primary lottery office where you reside, in which a W-2G also awaits you. This publish is within the New You can lottery. Other states might have different rules.

Winnings on Daily Fantasy Sports (DFS) contests are really thought games of skill. DFS sites will issue a 1099-MISC, not only a W-2G for winnings of $600 or higher.

Video Lottery Terminals (VLT)

$600 or higher in winnings within the class II â??Video Lottery Terminal game may also invite a W-2G. Including any winnings on machines at jurisdictions which are run by an condition lottery. For instance, New You can Condition has nine race tracks with VLT’s which are pseudo slot and electronic poker machines.

Deductions

The great factor throughout this is often that gambling losses are tax deductible only to the quantity of your winnings, and just in case you itemize deductions within your taxes.

The Us Government would really like to actually just indeed lost all you claim you lost, so tabs on all of your losses is needed. Win- loss statements can be found from most major casinos inside the finish of the year, provided you used your player’s club card when playing machines. Save individuals losing scratch-off tickets, Lotto, Powerball, and Mega-Millions tickets, daily figures, Quick Draw, OTB, etc.